Credit growth slump tightens finance access, raising concerns for jobs and expansion

To ease credit constraints, the government has rolled out measures including the Financial Inclusion Fund (Hustler Fund), risk-based credit pricing and reforms to credit information sharing.

Kenya’s domestic credit growth has sharply slowed, tightening access to finance for businesses and raising concerns about the pace of expansion and job creation.

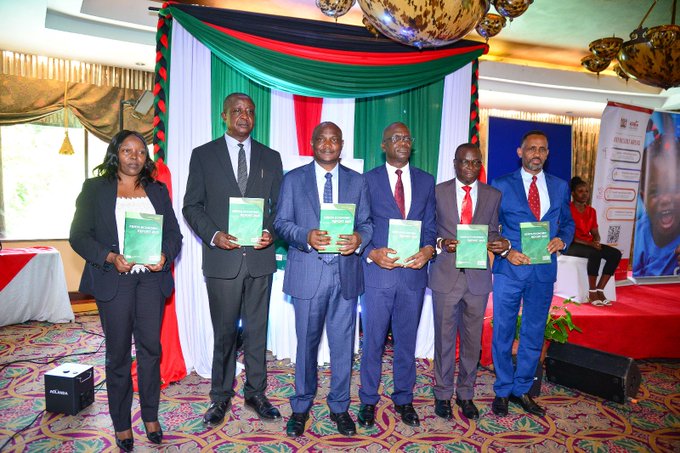

The latest economic update by the Kenya Institute for Public Policy Research and Analysis (KIPPRA) shows that overall domestic credit growth weakened significantly in 2024.

More To Read

- Weak savings, declining investment constrain Kenya’s job growth - report

- Kenya’s economic recovery not translating to quality jobs, report finds

- Kenya’s tax system narrows inequality but pushes more people into poverty - report

- NSSF contributions rise to Sh6,480 a month for top earners from February

- Over half of circular economy workers lack protection, ILO report finds

- CBK cuts lending rate to 9.00 per cent to boost business and household borrowing

“Domestic credit growth slowed to 1.3 per cent in 2024 from a growth of 12.6 per cent in 2023,” reads the researchers' "Kenya Economic Report 2025".

It attributes the slowdown to a marked shift in lending patterns, with banks prioritising government securities amid fiscal pressures and heightened risk perceptions in private lending.

Credit to the government emerged as the main driver of domestic credit expansion in the review period, contributing 1.2 percentage points to overall growth.

Lending to other public sector entities, including county governments and parastatals, added 0.6 percentage points, improving from a negative contribution in 2023 as sub-national entities increased borrowing for operations and development needs.

Historically, government borrowing played an outsized role during periods of crisis.

In 2020, amid fiscal responses to the Covid-19 pandemic, government credit contributed 11.1 per cent to domestic credit growth.

In the post-pandemic period, however, this contribution steadily declined, falling below pre-Covid levels to 3.37 per cent in 2023 and further to 1.2 per cent in 2024.

Private sector lending, traditionally the engine of employment-led growth, weakened substantially.

“The private sector contributed 0.6 percentage points in 2024, down from 12.7 percentage points contribution in 2023," Kippra added.

This decline reversed a steady rise seen between 2017 and 2023, when private sector credit contribution climbed from 3.0 per cent to 12.7 per cent, reflecting stronger business confidence and investment appetite.

Kippra notes that where credit flows matters for jobs.

“Credit to the public sector influences employment creation through infrastructure projects, public services, and social programmes, which generate both direct public-sector jobs and indirect employment through increased demand for goods and services from private enterprises.”

By comparison, private sector credit tends to spur more immediate hiring through firm expansion, capital investment and productivity gains.

Even so, the relationship between credit growth and employment is not always linear.

In 2020, domestic credit growth reached 17.0 per cent, driven by government borrowing, yet employment fell sharply to minus 4.1 per cent as lockdowns and weak labour demand blunted job creation despite increased liquidity in the economy.

As conditions normalised, the link strengthened.

Domestic credit grew by 14.86 per cent in 2021 and 11.45 per cent in 2022, alongside employment growth of 5.3 per cent and 4.5 per cent, respectively.

In 2023, credit growth of 12.64 per cent coincided with employment stabilising at 4.4 per cent, underscoring the role of broader economic and sectoral dynamics.

To ease credit constraints, the government has rolled out measures including the Financial Inclusion Fund (Hustler Fund), risk-based credit pricing and reforms to credit information sharing.

The Credit Guarantee Scheme, launched in 2020, has facilitated Sh6.18 billion in loans to MSMEs by 2023, though reliance on annual budget allocations has raised sustainability concerns.

To address this, the National Treasury is developing a Credit Guarantee Policy aimed at anchoring a more structured and long-term framework to revive private sector lending and support jobs-led growth.

Top Stories Today